Ready to Stop Stressing About Money?

Ever feel like your paycheck just vanishes? I’ve been there, wondering where all my cash went by the end of the month. Budgeting changed everything for me, and it can for you too. A solid budget helps you save more, stress less, and actually hit your financial goals, like building an emergency fund or taking that dream vacation. In this post, I’m breaking down three awesome budgeting methods, the 50/30/20 rule, zero-based budgeting, and the envelope system, that’ll help you save money fast in 2025. Plus, I’ve got a free Budget Planner Template to make it super easy. Wanna take control of your cash? Let’s dive in!

Why Budgeting Feels Hard (But It’s Totally Doable)

Budgeting can feel like a chore, especially when you’re juggling bills, unexpected expenses, or just trying to enjoy life a bit. Most people struggle because they don’t have a clear plan, or they pick a method that’s too complicated. Without a budget, it’s easy to overspend on takeout or subscriptions and end up with nothing saved. But here’s the good news: a simple budgeting method can turn that around. Studies show 78% of people who budget feel more confident about their finances. With the right approach, you could save $1,000 or more this year. Let’s check out three methods that actually work.

Your Path to Smarter Spending

These three budgeting methods are beginner-friendly but powerful enough to transform your finances. Each one’s different, so you can pick what fits your life. I’ll also share tools like You Need A Budget to make budgeting a breeze. Ready to start? Try You Need A Budget free and see how easy saving can be.

Three Budgeting Methods to Save Big

1. The 50/30/20 Rule

This method splits your income into three buckets: 50% for needs, 30% for wants, and 20% for savings or debt. It’s perfect if you want something simple.

- How: Take your after-tax income (say, $3,000/month). Spend $1,500 on needs (rent, groceries), $900 on wants (dining out, Netflix), and $600 on savings or debt. Use Rocket Money to track your spending.

- Why: It balances saving with enjoying life, so you don’t feel deprived. It’s great for beginners.

- Tip: Automate your savings by setting up a transfer to a high-yield savings account like Ally.

2. Zero-Based Budgeting

Zero-based budgeting means every dollar gets a job, so your income minus expenses equals zero. It’s ideal if you want total control.

- How: List your income, then assign every dollar to a category (bills, savings, fun) until nothing’s left. I use YNAB to make this easy.

- Why: It forces you to prioritize and cuts out wasteful spending. You’ll save faster.

- Tip: Review your budget weekly to stay on track and adjust as needed.

3. The Envelope System

This old-school method uses cash in envelopes for different spending categories. It’s great if you struggle with overspending.

- How: Decide your budget for categories like groceries or entertainment. Withdraw cash, put it in labeled envelopes, and only spend what’s there. Track leftovers with EveryDollar.

- Why: Physically seeing your cash disappear makes you think twice about spending.

- Tip: Keep one envelope for “miscellaneous” to cover small unexpected costs.

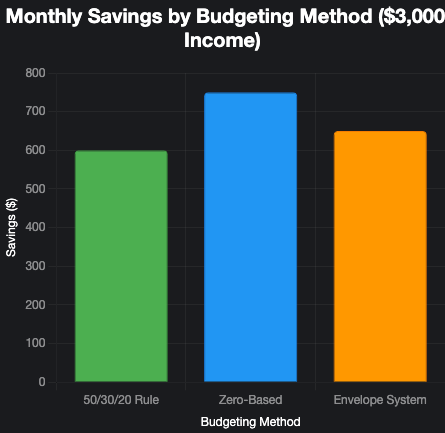

Visual: Comparing Budgeting Methods

Here’s how these methods stack up based on $3,000 monthly income:

Alt Text: Bar chart showing monthly savings potential for 50/30/20 rule, zero-based budgeting, and envelope system with $3,000 income.

Mistakes You Gotta Avoid

- Skipping Tracking: No matter the method, you need to track spending. Apps like Rocket Money make it painless.

- Being Too Strict: If your budget’s too tight, you’ll quit. Leave room for small treats.

- Forgetting Irregular Expenses: Plan for things like car repairs or gifts to avoid surprises.

- Not Adjusting: Life changes, so tweak your budget monthly.

More questions? Check my contact page and send me a message directly for extra budgeting tips!

Start Saving Like a Pro Today

Budgeting doesn’t have to suck. Pick one of these methods—50/30/20, zero-based, or envelope—and you’ll start seeing more money in your savings account fast. Tools like YNAB can make it even easier to stick with it. Try one, stick with it for a month, and watch your financial stress melt away. Grab my free Budget Planner Template to kick things off Click Here! Ready to level up? Sign up for YNAB for free and start saving smarter. Share this post with a friend who’s ready to save big, and let’s make money grow easy together!

Disclosure: I may earn a commission from purchases made through links in this post. Thanks for supporting Money Grow Easy!

Leave a Reply