1. Check Your Credit Report for Errors

Mistakes on your credit report, like incorrect late payments or accounts that don’t belong to you, can drag your score down fast. According to the FTC, 1 in 5 reports have errors.

- What to do: Get your free reports from Equifax, Experian, and TransUnion at AnnualCreditReport.com.

- Tool to use: Experian makes it easy to monitor and flag changes.

- Why it matters: Disputing errors can improve your score by 20 to 50 points in a matter of weeks.

- Tip: Dispute errors online and keep screenshots for your records.

2. Pay Bills on Time, Every Time

Payment history makes up 35% of your FICO score. Just one missed payment can drop your score by over 100 points.

- What to do: Set reminders or use autopay to make sure your bills, credit cards, loans, utilities, get paid on time.

- Why it matters: On-time payments consistently improve your credit profile.

- Tip: Even if you can’t pay in full, always pay at least the minimum by the due date.

3. Lower Your Credit Utilization Ratio

Credit utilization means how much of your available credit you’re using. The goal is to stay under 30% of your total limit, and under 10% if you want the best results.

- What to do: Pay down high-balance cards and consider requesting a credit limit increase.

- Tool to use: Credit Karma helps you monitor this in real time.

- Tip: Spread purchases across multiple cards to keep balances low.

4. Pay Off Small Debts First (Debt Snowball)

The debt snowball method gives you momentum. By paying off smaller debts first, you rack up wins that keep you motivated.

- What to do: List your debts from smallest to largest. Pay minimums on all, but throw extra cash at the smallest one until it’s gone.

- Why it matters: It strengthens your credit mix and payment history.

- Tip: Download my free Debt Payoff Tracker to stay organized.

5. Become an Authorized User

If someone you trust has a credit card with a solid history, you can piggyback off it.

- What to do: Ask a family member or close friend to add you as an authorized user. They don’t need to give you the card itself.

- Why it matters: You’ll benefit from their positive payment history and low utilization.

- Tip: Only do this if they have a strong payment record and keep balances low.

6. Avoid Closing Old Accounts

Your credit age makes up 15% of your score. Closing older accounts can shrink your history and raise your utilization.

- What to do: Keep old cards open, even if you don’t use them often.

- Why it matters: A longer history tells lenders you’re stable and reliable.

- Tip: Make a small purchase every few months and pay it off immediately to keep the card active.

7. Consider a Secured Credit Card

If you can’t get approved for a traditional card, a secured credit card is a great option to rebuild from the ground up.

- What to do: Apply for a secured card backed by a small deposit (usually $200 or so).

- Card to try: Discover Secured Card is a solid pick, no annual fee and it reports to all three bureaus.

- Tip: Use it for small expenses, pay it off in full, and treat it like a regular card.

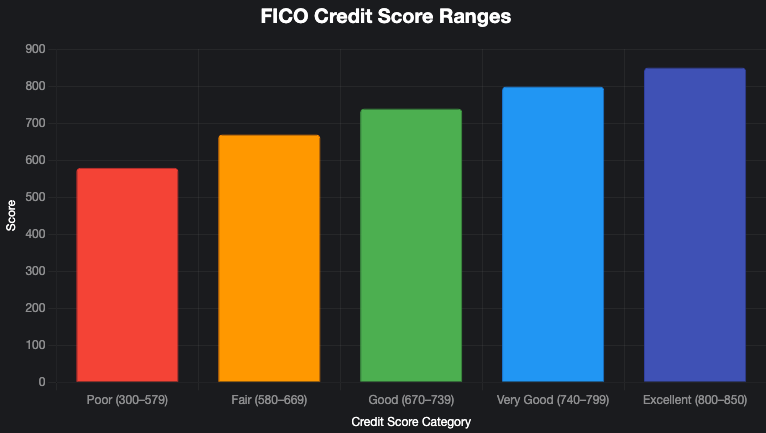

Credit Score Ranges

Common Mistakes to Avoid

- Closing old accounts: This shortens your credit history.

- Applying for too many cards: Each app adds a hard inquiry, dropping your score.

- Ignoring your credit report: Errors don’t fix themselves. Review it at least once a year.

- Maxing out cards: High balances crush your score. Pay them down aggressively.

Take Control of Your Credit Today

Improving your credit score doesn’t have to take years, and you don’t need to hire an expensive credit repair company. With the right tools and daily habits, you can see real progress in just a few months.

Start by grabbing your free credit reports. Then follow these 7 steps consistently. Use tools like Experian to track your progress, and download my Credit Score Checklist to stay on track.

Ready to see your score improve? Sign up for Experian and monitor it for free.

Know someone who needs this? Share the post and help them grow their money too.

Disclosure: This post may include affiliate links. If you click and buy, I may earn a small commission—at no extra cost to you. I only recommend tools I personally believe in.

Leave a Reply